Medical Plan Selections

Medical plans

Your Choice!

There are four unique medical plan options, but certain plans include a choice of the two networks listed below:

- National PPO - a comprehensive network throughout the country.

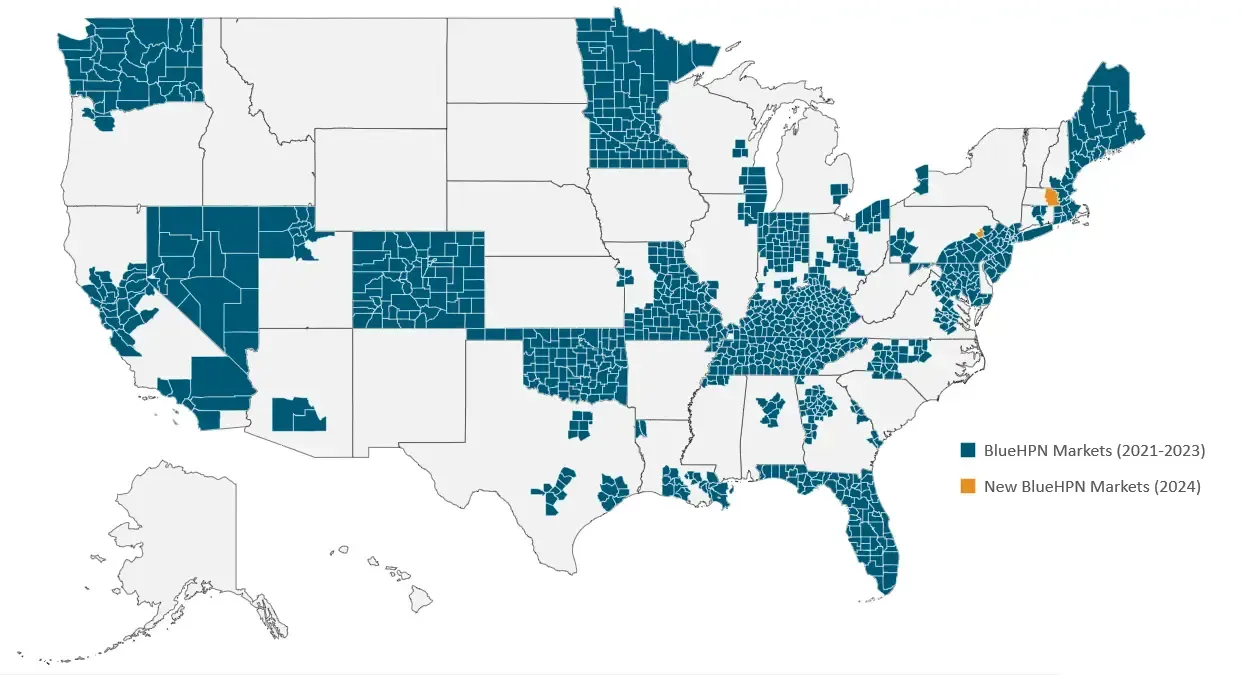

- High Performance Network (HPN) - a much narrower selection of providers who charge less for their services and agree to a higher level of managed care from Blue Cross Blue Shield of Arizona.

What is the HPN? How does it work?

Basic High Deductible Health Plan

This plan works with the Health Savings Account

NOTE: Be sure to review HPN providers in your area before committing to the the Narrow Network option.

| Feature | Benefit |

|---|---|

| Calendar Year Deductible | $3,500 Individual $7,000 Family |

| Max. Out-of-Pocket | $5,000 Individual $10,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | 80% After Deductible |

| Lab/X-ray | 80% After Deductible |

| Hospital Services | 80% After Deductible |

| Emergency Services | 80% After Deductible |

| Prescription Drugs | 80% After Deductible |

The Basic High Deductible Plan Broad Network is Preferred Provider Organization (PPO) plan. This means the plan does allow "out-of-network" coverage. Providers not within the network may "balance bill" for charges not covered by the plan.

The Basic High Deductible Plan Narrow Network is an Exclusive Provider Organization (EPO) plan. This means there is no "out-of-network" coverage. All care must be rendered within the EPO network (The HPN network).

As an HDHP plan, all charges apply as an out-of-pocket expense until the deductible is satisfied. The exception would be Preventive Care, which is covered at 100%

Enhanced High Deductible Health Plan

This plan works with the Health Savings Account

NOTE: Be sure to review HPN providers in your area before committing to the the Narrow Network option.

| Feature | Benefit |

|---|---|

| Calendar Year Deductible | $2,000 Individual $4,000 Family |

| Max. Out-of-Pocket | $2,000 Individual $4,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | 100% After Deductible |

| Lab/X-ray | 100% After Deductible |

| Hospital Services | 100% After Deductible |

| Emergency Services | 100% After Deductible |

| Prescription Drugs | 100% After Deductible |

The Enhanced High Deductible Plan Broad Network is Preferred Provider Organization (PPO) plan . This means the plan does allow "out-of-network" coverage. Providers not within the network may "balance bill" for charges not covered by the plan.

The Enhanced High Deductible Plan Narrow Network is an Exclusive Provider Organization (EPO) plan. This means there is no "out-of-network" coverage. All care must be rendered within the EPO network (The HPN network)

As an HDHP plan, all charges apply as an out-of-pocket expense until the deductible is satisfied. The exception would be Preventive Care, which is covered at 100%

Premium PPO Plan

This plan works with the Flexible Spending Account

| Feature | Benefit |

|---|---|

| Calendar Year Deductible | $2,000 Individual $4,000 Family |

| Max. Out-of-Pocket | $4,000 Individual $8,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | $20 copay / $40 Copay |

| Lab/X-ray | 80%; No Deductible |

| Hospital Services | 80%; After Deductible |

| Emergency Services | $250 Copay |

| Prescription Drugs | Tier 1: $10 |

| Tier 2: $35 | |

| Tier 3: $50 | |

| Tier 4: 20% |

The Premium PPO Broad Network Plan is Preferred Provider Organization plan (PPO). This means the plan does allow "out-of-network" coverage. Providers not within the network may "balance bill" for charges not covered by the plan.

As a PPO, the plan features copayments, lower deductible, and coinsurance. So some care - mostly outpatient, ambulatory services - are covered after a relatively low copay.

The above illustrations are intentionally brief for easy and quick comparison. They are not intended to represent the complete benefit descriptions of the plans shown. Please refer to actual plan documentation for a complete explanation of benefits and exclusions.

Premium Subsidy

Verra Mobility provides an additional medical premium subsidy for all benefits-eligible employees who earn an annual base salary under $50,000. Annual base salary for hourly employees is calculated by multiplying your hourly rate by 2,080 hours per year (overtime earnings are not included in the calculation). You must be enrolled in one of Verra Mobility’s medical plans to receive the subsidy.

The subsidy is provided through lower medical premium rates deducted from each paycheck while you are enrolled in a medical plan.

The premium rates shown in this site in the “<$50k Base Salary” columns show you what your cost will be after the subsidy is applied.

If the medical premium for the plan you elect is less than the subsidy, your premium cost will be $0 and you will not receive the difference. If your base salary is increased above $50,000, the subsidy will stop in the first paycheck reflecting your new pay rate.

| Enrollment | Subsidy |

|---|---|

| Employee Only | $20 |

| Employee + Spouse | $50 |

| Employee + Child(ren) | $50 |

| Employee + Family | $75 |

High Performance Network

More about the HPN

Notice that there are four separate medical plan selections, but certain plans (3500 HDHP, 2000 HDHP, and 2500 PPO plan, provide a choice of two distinct provider networks. You can either select the National PPO plan or the High Performance Network plan (HPN).

Learn how to navigate the provider search tool

Medical Options

For 2025 you have the following medical plan options to choose from Blue Cross Blue Shield of Arizona.

Preferred Provider Organization

(Blue Cross Blue Shield of Arizona)

(Broad Network)

Things PPO members should keep in mind

A PPO medical plan offers a wide range of benefits and flexibility for individuals and businesses alike. One of the key features of a PPO plan is the ability to choose your own healthcare providers without needing a referral. This allows for greater control over your healthcare decisions and ensures that you receive the best possible care.

Keep in mind, the PPO provider charges are discounted, and there is no "balance billing" when using a provider from the PPO network. Out-of-network care (using a provider not associated with the PPO network) is different. Out-of-network providers may have higher charges and the ability to bill you for charges deemed "not covered" by our plans.

High Performance Network (HPN)

(Blue Cross Blue Shield of Arizona)

(Narrow Network)

By partnering with a select group of high-quality providers, this network offers superior care at lower costs, resulting in improved health outcomes and increased savings for employees. With access to leading hospitals, physicians, and specialists, you and your family can receive the best care possible while keeping healthcare expenses in check.

Keep in mind, the HPN is a narrowed network PPO option that can be regionally limited. Please check the HPN network to make sure you are satisfied with the provider selection in your area.

Assistance

Member Services number on your ID card or contact the Benefit Resource Center at 888-336-7463.

Call your PCP before seeking any urgent care. If you have a life or limb threatening emergency, seek care immediately and call your PCP as soon as you can.

Pharmacy Benefits

Go to https://www.azblue.com/pharmacy

Here you will discover several useful tools to help you manage your household's prescription drugs:

- Price Edge discount pharmacy program

- Price a Drug Tool

- Understand and maximize your AZBlue pharmacy coverage

Eligibility

Eligible Employees:

You may enroll in the Employee Benefits Program if you are a full-time employee who is actively working 30 hours or more per week.

Eligible Dependents:

If you are eligible for our benefits, then your dependents are too. In general, eligible dependents include:

- Your Legal Spouse

- Civil Union - Colorado

- Common Law Spouse in Colorado, Idaho

- Registered Domestic Partner in California, Nevada, Oregon and Washington and children up to age 26

- If your child is mentally or physically disabled, coverage may continue beyond age 26 once proof of the ongoing disability is provided

- Children may include natural, adopted, stepchildren and children obtained through court-appointed legal guardianship, as well as children of state-registered domestic partners

When Coverage Begins:

Newly hired employees and dependents will be eligible on the first day of the month following 30 days of employment. All elections are in effect for the entire plan year and can only be changed during Open Enrollment unless you experience a Qualifying Life Event.

Qualifying Life Event:

- A Qualifying Life Event is a change in your personal life that may impact your eligibility or dependent’s eligibility for benefits. Examples of some family status changes include:

- Change of Legal Marital Status (i.e. marriage, divorce, death of spouse, legal separation)

- Change in Number of Dependents (i.e. birth, adoption, death of dependent, ineligibility due to age)

- Change in Employment or Job Status (spouse loses job, etc.)

- If such a change occurs, you must make the changes to your benefits within 30 days of the event date; 60 days for loss of Medicaid or state child health plan. Documentation may be required to verify your change of status. Failure to request a change of status within 30 days of the event or 60 days for loss of Medicaid or state child health plan coverage, may result in your having to wait until the next open enrollment period to make your change. Please contact HR to make these changes.

Changes in Elections

Qualifying Life Events are specific life events that allow individuals to make changes to their health insurance coverage outside of the regular enrollment period. These events include:

- Marriage or divorce

- Birth or adoption of a child

- Loss of other health coverage

- Change in residence that affects health plan options

- Change in employment status

- Turning 26 and aging out of a parent's health plan

- Qualifying Life Events allow you to enroll in a new health plan, add or remove dependents from your coverage, or make other changes to your health insurance outside of the regular enrollment period.

When?

You must notify Human Resources within 30-days of your Qualifying Life Event to be eligible to make changes during the plan year.

How?

If you have had a Qualifying Life Event, you must notify Human resources of your event and that you would like to make changes to your benefit plan elections.