Life Insurance

Basic Life and Accidental Death & Dismemberment (AD&D) coverage.

Your basic life insurance and accidental death and dismembered insurance is a benefit fully paid by Verra mobility.

Basic Life Insurance

The basic life policy covers you up to 1x your annual base salary, up to $400,000.

Accidental Death & Dismemberment

If you're passing is a result of an accident, the A&E benefit is equal to the basic life insurance benefit of one times your annual base salary, up to $400,000

Beneficiary

Please review your benefits area assignments to ensure that all the information is up-to-date and correct.

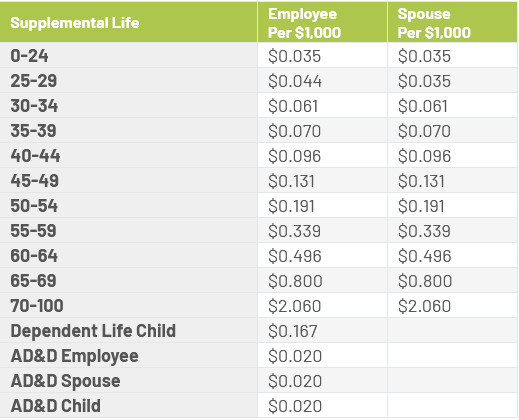

Supplemental Life Insurance

Verra Mobility provides you the option to purchase Supplemental Life and AD&D insurance for yourself, your spouse, and your dependent children through Prudential.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. When you enroll you will see your exact cost for coverage based on your age and how much you buy. Benefits will reduce by 50% at age 70. For Spouse coverage benefits will reduce by 100% at age 70.

- Employee: $10,000 increments up to 5x annual earnings or $500,000, whichever is less—guarantee issue: $200,000

- Spouse: $5,000 increments up to $150,000 or 100% of the employee’s election, whichever is less—guarantee issue: $30,000

- Dependent children: Birth to age 26: $10,000—guarantee issue: $10,000

If you elect supplemental coverage, you may purchase up to the guaranteed issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you may be required to submit evidence of insurability (EOI) for the coverage you request. Any amounts requiring EOI will not take effect until approved by Prudential.

Depending on your personal situation, Basic Life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, you may want to purchase supplemental coverage.

Use the Life Insurance Needs Calculator to help determine how much coverage is right for you.

Benefit Decision Tool