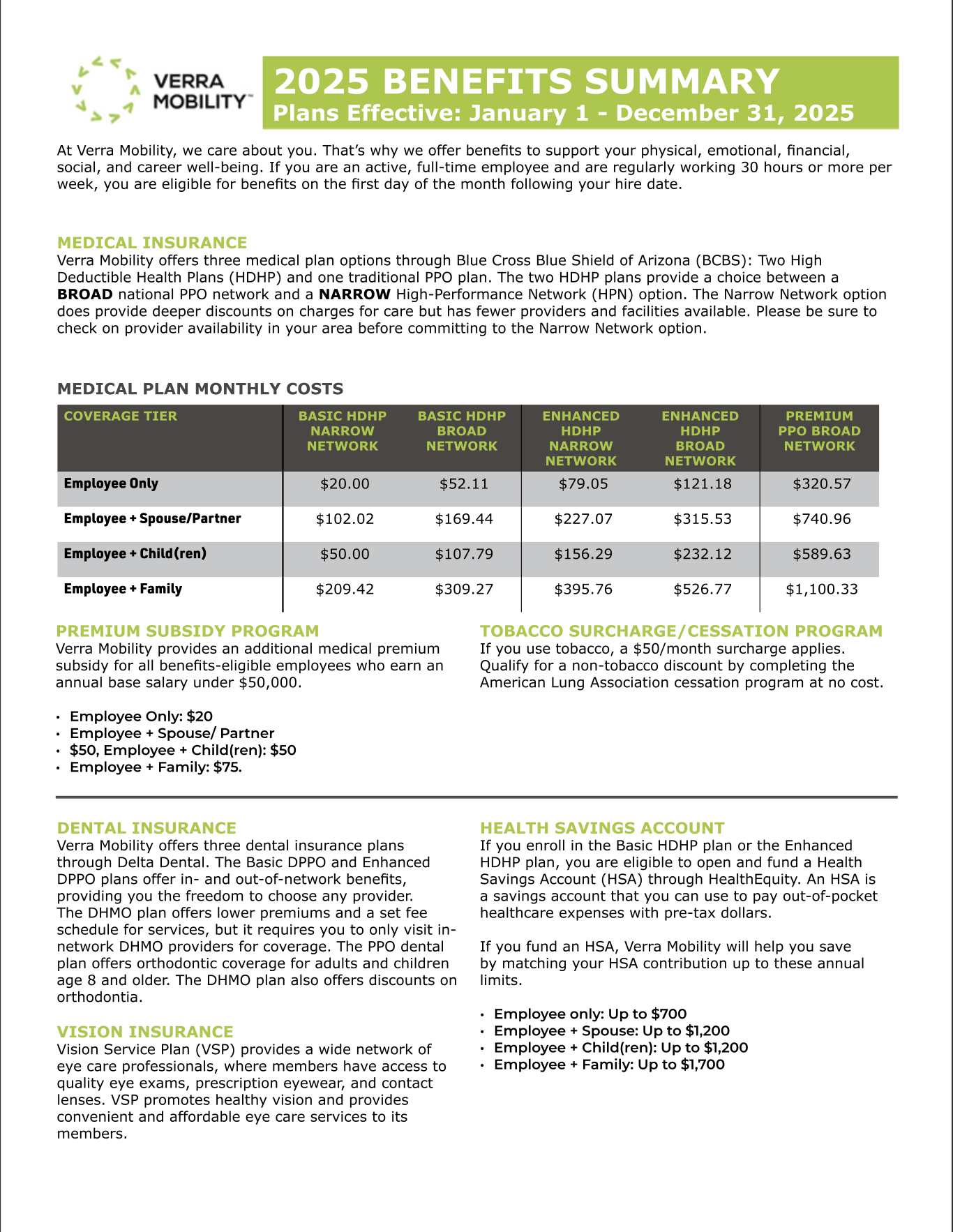

Commuter Benefits

Benefit Decision Tool

Commuter benefits allow you to put money from your paycheck aside each month,

before taxes are taken out, for qualified mass transit and parking expenses.

Commuter Benefits

What does it cover?

Commuter funds can be used on a variety of transportation and parking expenses that allow you to travel to and from work. Eligible modes of

transportation include but aren’t limited to:

- Train or Ferry

- Bus or Subway

- Vanpool (must seat at least 6 adults)

- Parking or parking meter near your place of employment

Maximum Contributions

- Commuter Transit: $325

- Commuter Parking: $325

Contribution changes

You can adjust the amount you contribute to the plan each month at any time. No qualifying event is needed.

Rollovers and use-or-lose

The commuter plan is flexible and your funds will continue to roll over month to month until the funds are used. However, your funds will no longer be available if you terminate employment