Dental

Benefit Decision Tool

Your Smile, Our Priority

Explore Our Dental Insurance Plans

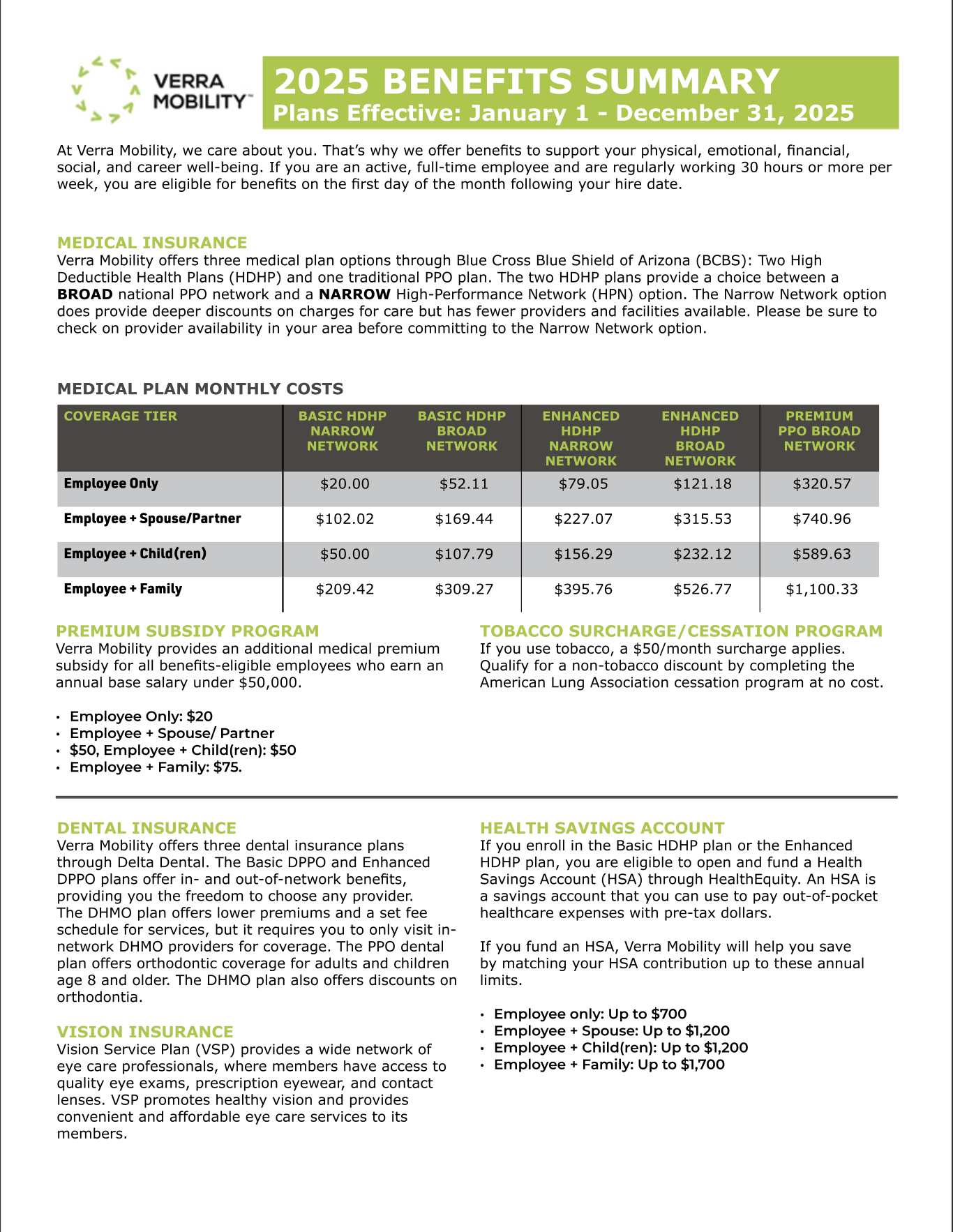

Verra Mobility is excited to offer three comprehensive dental insurance plans through Delta Dental, tailored to meet your needs. Our Base plan (Delta Basic DPPO) and Buy-Up plan (Delta Enhanced DPPO) plans provide both in- and out-of-network benefits, giving you the flexibility to choose any provider. For maximum savings, we recommend selecting a Delta Dental provider. You can easily find a network provider by visiting deltadentalaz.com.

Our DeltaCare USA Health Maintenance (DHMO) plan offers exclusive in-network benefits, ensuring you receive quality care at a lower cost. To locate a network provider for this plan, please visit deltadentalins.com

Below, you'll find a summary table highlighting the key features of each dental plan. The coinsurance amounts reflect the plans share of the costs. For detailed information on coverage and exclusions, please refer to the official plan documents.

Choose the plan that best suits your needs and enjoy the peace of mind that comes with excellent dental coverage!

01 Basic DPPO Plan

The Basic DPPO plan offers essential coverage with flexibility and choice. As with any PPO, selecting a participating provider benefits you in two ways: lower cost per service and the provider will not balance bill for amounts greater than the contracted rate.

02 Enhanced DPPO Plan

The Enhanced DPPO plan works the same as the Basic DPPO plan, but with more benefit dollars available for you and your family's dental care. Plus, this plan covers orthodontic services!

03 DeltaCare HMO Plan

The DeltaCare DHMO plan works differently than a PPO. As a Dental Health Maintenance Organization, you are required to receive services from participating DeltaCare DHMO network providers. Also, instead of an annual maximum, you can receive unlimited services at predetermined costs, captured in the DeltaCare DHMO fee schedule.

Basic DPPO Plan

| Feature | In-PPO / Non-PPO |

|---|---|

| Calendar Year Deductible (Individual/Family) | $50 / $150 |

| Calendar Year Maximum Benefit | $1,200 |

| Preventive Care | 100% / 80% |

| Basic Care (Deductible Applies) | 80% / 60% |

| Major Care (Deductible Applies) | 50% / 30% |

| Orthodontic Care | Not Covered |

In the Basic DPPO plan, coinsurance amounts for Texas residence are the same in and out of the PPO network.

Enhanced DPPO Plan

| Feature | In-PPO / Non-PPO |

|---|---|

| Calendar Year Deductible (Individual/Family) | $50 / $150 |

| Calendar Year Maximum Benefit | $2,000 |

| Preventive Care | 100% / 100% |

| Basic Care (Deductible Applies) | 80% / 80% |

| Major Care (Deductible Applies) | 50% / 50% |

| Orthodontic Care | 50% up to $2,000 lifetime benefit |

In the Enhanced DPPO plan, coinsurance amounts for Texas residence are the same in and out of the PPO network.

Delta DHMO Plan

| Feature | In Network Only |

|---|---|

| Calendar Year Deductible (Individual/Family) | None |

| Calendar Year Maximum Benefit | None |

| Preventive Care | See copay schedule |

| Basic Care | See copay schedule |

| Major Care | See copay schedule |

| Orthodontic Care | See copay schedule |

The Delta DHMO plan is not available for Puerto Rico residents.

Dental Costs

Listed below are the monthly costs for dental insurance. The amount you pay for coverage is deducted from your paycheck on a pre-tax basis, which means you don’t pay taxes on the amount you pay for coverage.

| Enrollment | Delta Dental Basic DPPO | Delta Dental Enhanced DPPO | DeltaCare DHMO Plan |

|---|---|---|---|

| Employee Only | $13.88 | $22.53 | $8.26 |

| Employee + Spouse | $26.29 | $43.40 | $16.52 |

| Employee + Child(red) | $28.14 | $49.68 | $18.27 |

| Employee + Family | $41.81 | $72.72 | 27.16 |