Voluntary Insurance Products

Accident Insurance

Verra Mobility provides you the option to purchase Accident insurance through Cigna.

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident. Refer to the Cigna flyer to view plan details and compare the three plan options.

Examples of covered conditions

- Burns

- Dislocations

- Lacerations

- Broken Bones

- Concussion

- Fractures

- Medical service related to an

- accident

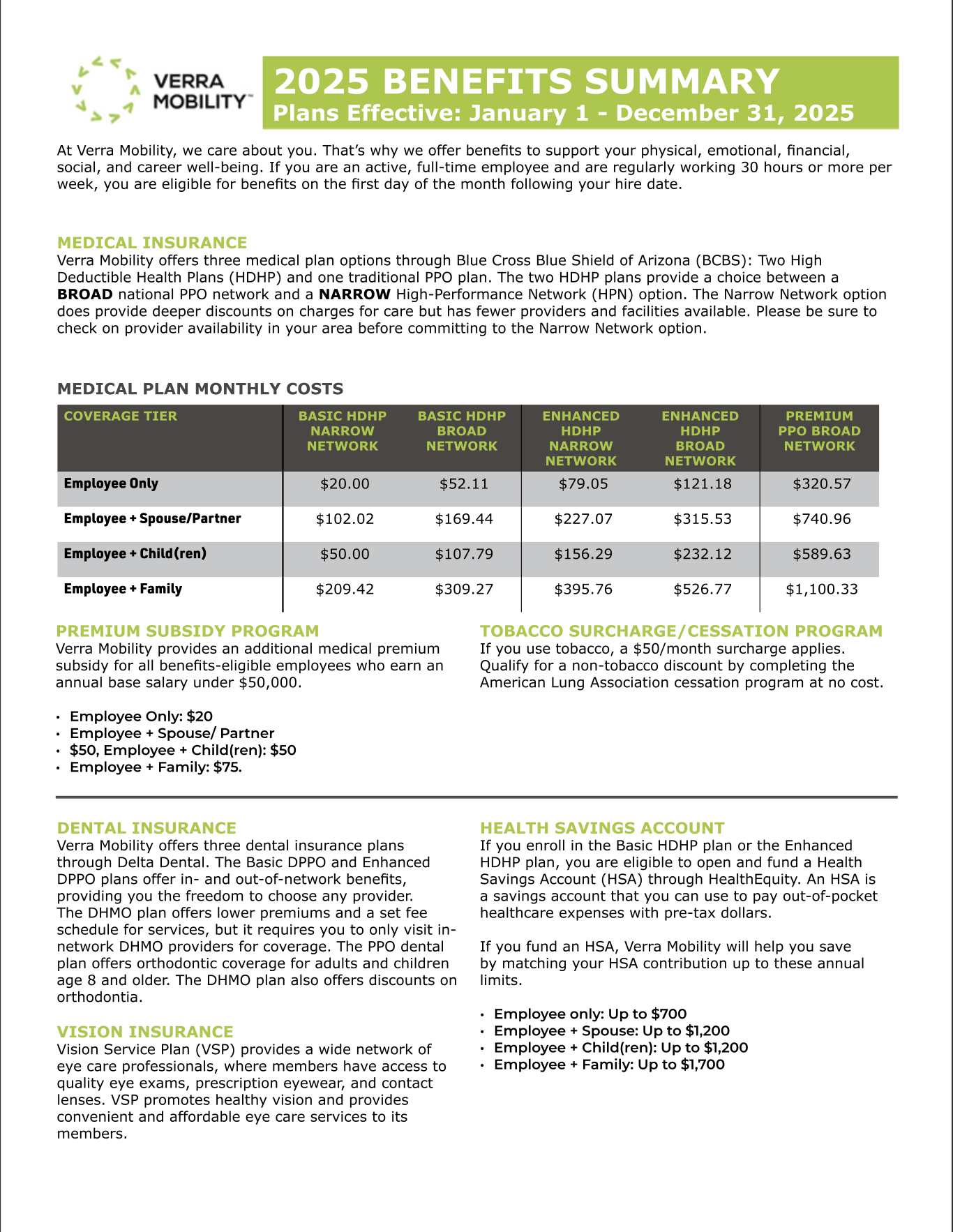

Accident insurance costs

Listed here are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Accident Low Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $6.25 |

| Employee + Spouse | $9.82 |

| Employee + Child(ren) | $10.38 |

| Employee + Family | $16.34 |

Accident Mid Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $10.54 |

| Employee + Spouse | $16.62 |

| Employee + Child(ren) | $18.82 |

| Employee + Family | $29.39 |

Accident High Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $15.12 |

| Employee + Spouse | $23.29 |

| Employee + Child(ren) | $26.67 |

| Employee + Family | $41.73 |

Critical Illness

Verra Mobility provides you the option to purchase Critical Illness insurance through Cigna.

Critical Illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

A health screening benefit is automatically included in the plan. This plan will pay $50 per insured individual per calendar year when a covered health screening test is performed.

Examples of covered conditions

- Circulatory conditions such as heart

- attack or stroke

- Cancer conditions

- Other conditions such as benign

- brain tumor, major organ failure,

- paralysis, and coma

Benefit options

- Employee: $5,000, $10,000, $15,000, $20,000

- Spouse/Domestic Partner: $5,000, $7,500, $10,000

- Child(ren): $5,000

Rates are age banded for employee and spouse differentiating between smoker and non-smoker. Spouse rates are based on the employee’s age. Child rates are a flat dollar amount. Refer to the Cigna flyer to view plan details and costs. If you choose to increase your coverage or are electing coverage for the first time, you will be subject to pre-existing condition limitations.

Hospital Indemnity Insurance

Verra Mobility provides you the option to purchase Hospital Indemnity insurance through Cigna.

A hospital stay can happen at any time, and it can be costly. The Hospital Indemnity plan can help you and your loved ones have additional financial protection. This plan pays benefits for hospitalizations resulting from a covered injury or illness. Coverage continues after the first hospitalization, to help you have protection for future hospital stays.

A health screening benefit is automatically included in the plan. This plan will pay $50 per insured individual per calendar year when a covered health screening test is performed.

The table to the right highlights some of the benefits of the Hospital Indemnity plan. Please refer to the Cigna plan summary for additional details. Benefits will be subject to pre-existing condition limitations.

Pet Insurance

Nationwide offers two plans for you to choose from: My Pet Protection® and My Pet Protection® with Wellness500.

My Pet Protection is a medical plan that offers an annual benefit of $7,500 for eligible veterinary bills related to accidents, injuries and illnesses, including emergency clinics and specialists.

My Pet Protection with Wellness500 offers the same protection as our medical plan, but includes coverage for preventive care. With this plan, up to $500 of the annual $7,500 benefit can be used for wellness, including checkups, flea and heartworm preventives, vaccinations, spay and neuter and more.

Both plans are guaranteed issuance, have a $250 annual deductible and include medical coverage with the choice of 50% or 70% reimbursement levels.

Identity Theft Protection Plan

Verra Mobility provides you the option to purchase Identity Theft through allstate.

For January 1, 2026 Identity Theft Protection through Allstate is provided on a voluntary basis. If you choose to enroll into this coverage, you will be responsible for 100% of the cost.

We know that tracking your own identity can be complicated and

overwhelming, so we’re here to take the burden off your shoulders so you

can live your life.

Allstate uses proprietary software to proactively monitor information you provide. Through Allstate Identity Protection, you will also have the power to create thresholds for your bank accounts, allowing you to receive alerts for suspicious financial transactions outside of your set limits. Allstate monitors your credit reports and credit-related accounts to ensure no one is using your name fraudulently, and they monitor the dark web to check for compromised credentials and unauthorized account access. While they can’t prevent fraud, they can and do alert you at its very first sign, then work to resolve the fraud and restore your identity.

Below is a list of the various features that is offered through the Allstate Identity Protection plan:

- Allstate Scam Protection(SM)

- Identity restoration support features

- Dark web monitoring

- Financial transaction monitoring

- High-risk transaction monitoring

- Credit monitoring and alerts

- Elder Fraud Center

- Identity Theft reimbursement

- Fraud restoration tracker

- and more!

| Enrollment | Per Month |

|---|---|

| Per Person | $7.95 |

| Per Family | $13.95 |

Benefit Decision Tool