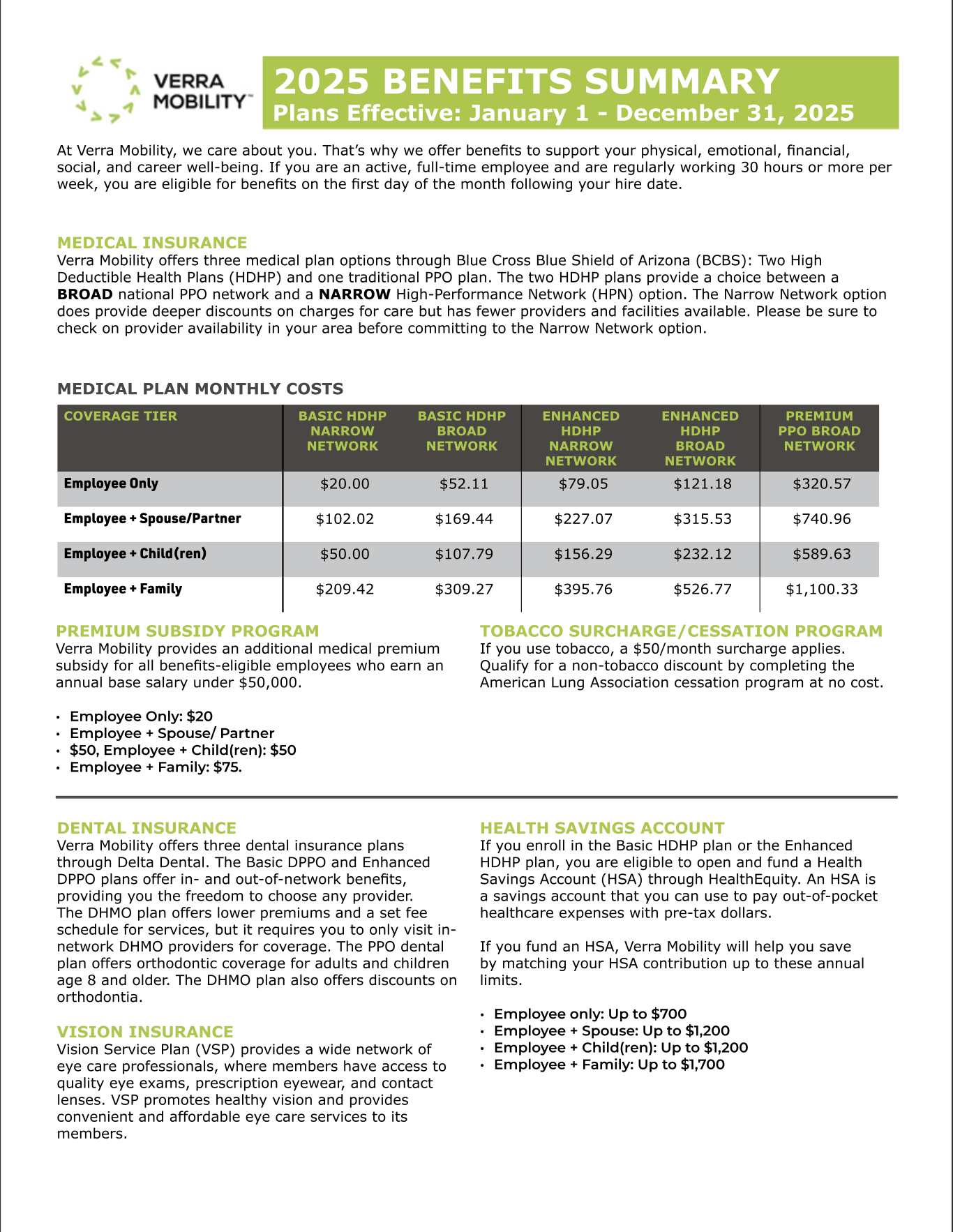

Health Savings Account

HSA Match and Contribution Limits

Verra Mobility HSA Match

In addition to the triple-tax savings benefit of the Health Savings (HSA), Verra Mobility will match your deposits, up to the following limits:

Employee only: Up to $700

Employee + Spouse: Up to $1,200

Employee + Child(ren): Up to $1,200

Employee + Family: Up to $1,700

2026 HSA Contribution Limits

In 2026, the maximum deposit for an individual is $4,400 per individual and $8,750 for families. Plus, if you are 55+, you may deposit an additional $1,000. Verra Mobility will help you save by matching your HSA contribution. This contribution will be pro-rated and will occur in every paycheck.

Note: The above limits are from all sources. Specifically, Verra Mobility matches your contributions toward your HSA (please see below for more details). Therefore, the maximum contribution limit is the combination between the amount you and Verra Mobility contribute toward your account.

What is an HSA?

A Health Savings Account (HSA) is a tax-advantaged account that allows you to save for medical expenses. It works in conjunction with a High-Deductible Health Plan (HDHP) and offers benefits like tax-free contributions and withdrawals for qualified medical expenses.Who can contribute to an HSA?

Anyone enrolled in a qualified HDHP can contribute to an HSA. This includes individuals with self-only or family coverage. Contributions can be made by the account holder, their employer, or anyone else on their behalf.Does Verra Mobility make a contribution toward my HSA?

If you enroll in the Base HDHP or Enhanced HDHP plan, Verra Mobility will help you save by matching your HSA contribution. This contribution will be pro-rated and will occur in every paycheck. For new hires, Verra Mobility’s first contribution will be made within the first pay period after you are benefits-eligible.

What are the tax benefits?

HSAs offer triple tax benefits: contributions are tax-deductible, the account grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a powerful tool for managing healthcare costs.Can I deposit to an HSA and have another plan, like an FSA?

No. You are not allowed to enroll and contribute toward the traditional Health Care FSA, while also being enrolled in the HSA. There is an FSA that is compatiable with your HSA. You may only enroll and contribute toward a Limited Purpose FSA along side your HSA.

Do I lose my money if I don't use the funds at the end of the year?

No. Unlike the FSA where the funds are use it or lose it, funds in the HSA rollover from year to year.

Benefit Decision Tool