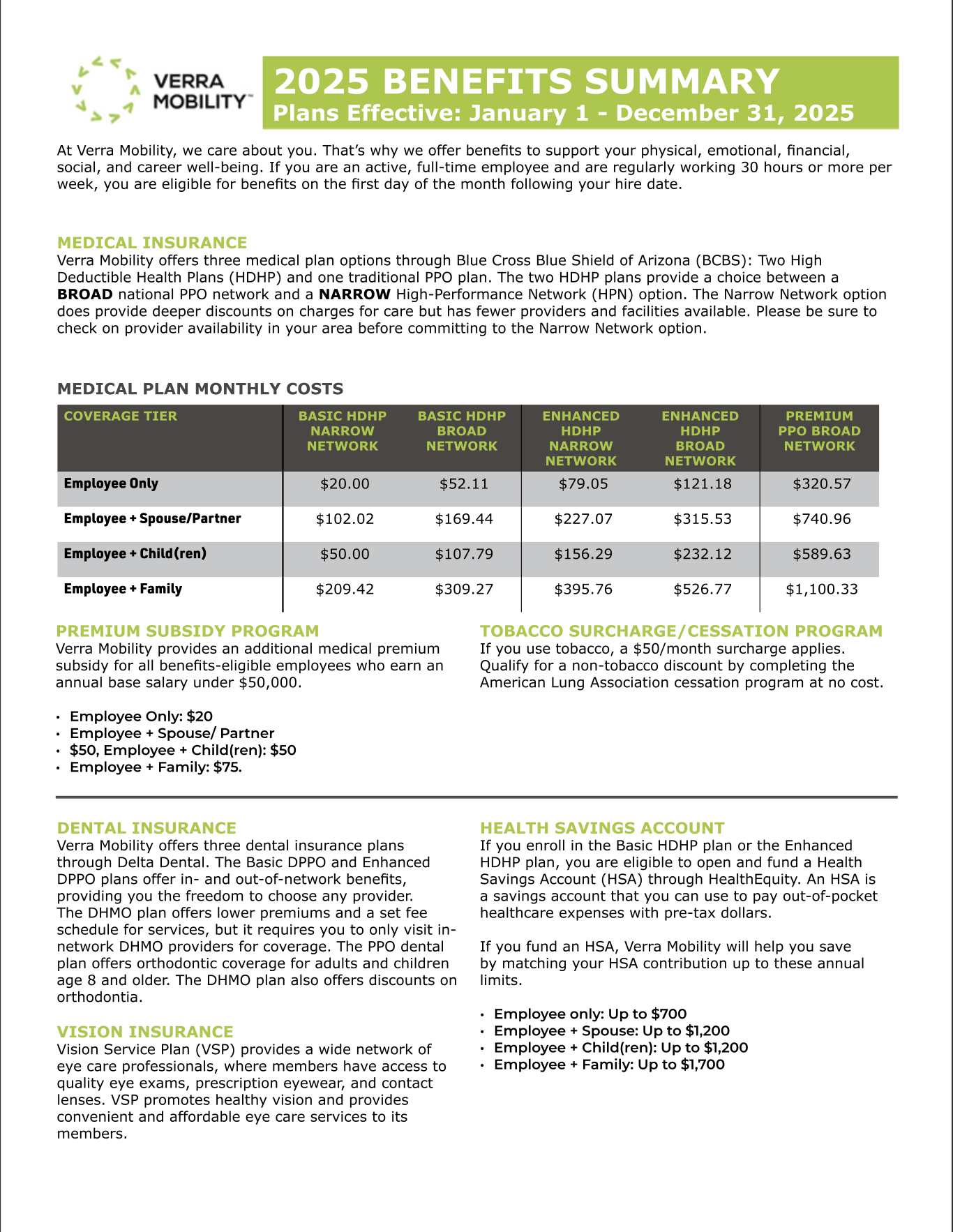

Flexible Spending Account

Health Care FSA

The Health Care Flexible Spending Accounts (FSA) can be used to cover a wide range of expenses, including co-pays, deductibles, prescription medications, and certain over-the-counter items. Health Care FSAs offer a tax advantage by reducing taxable income and can help individuals save money on out-of-pocket healthcare costs.

Limits

As of 2026, the Health Care FSA contribution limits is set at $3,400 per year. These limits are subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Rollover

Funds remaining in the Health Care FSA will rollover to the following year. Any funds that exceed $680 will be lost. You have 90 days after the end of the year to submit for reimbursement for the current year expenses.

To avoid overfunding your Health Care FSA, carefully consider your regular out-of-pocket, eligible medical expenses and best estimate what you may spend in 2026.

Limited Purpose FSA

A Limited Purpose Flexible Spending Account (FSA) is a type of account that allows you to set aside pre-tax dollars to pay for eligible medical expenses.

Unlike a traditional Health Care FSA, a Limited Purpose FSA has restrictions on the types of expenses that can be reimbursed, typically only covering specific expenses such as dental and vision care.

Limited Purpose FSAs are often offered in conjunction with a high-deductible health plan and are subject to annual contribution limits set by the employer. Any funds left in a Limited Purpose FSA at the end of the plan year may be forfeited, so it's important to plan expenses carefully.

Limits

As of 2026, the Limited Purpose FSA contribution limits is set at $3,400 per year. These limits are subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Rollover

Funds remaining in the Limited Purpose FSA will rollover to the following year. Any funds that exceed $680 will be lost. You have 90 days after the end of the year to submit for reimbursement for the current year expenses.

To avoid overfunding your Limited Purpose FSA, carefully consider your regular out-of-pocket, eligible medical expenses and best estimate what you may spend in 2026.

Dependent Care FSA

A Dependent Care Flexible Spending Account (DFSA) is a pre-tax benefit account that allows employees to set aside money to cover eligible dependent care expenses. These expenses typically include child care, day care, preschool, summer day camp, and before or after school care for children under the age of 13, as well as care for elderly or disabled dependents.

Employees contribute a portion of their pre-tax salary to the Dependent Care FSA, which can then be used to reimburse themselves for eligible expenses. This can result in significant tax savings, as the contributions are not subject to federal income tax, Social Security tax, or Medicare tax.

Limits

The DFSA limit is $7,500 per household, or $3,750 if married and filing separately. This limit is subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Use It Or Lose It

It's important to note that funds in a Dependent Care FSA are "use it or lose it," meaning that any unused funds at the end of the plan year are forfeited. However, some employers may offer a grace period or carryover option to allow employees to use up remaining funds.

Using Your FSA, LFSA, or DFSA

Filing an expense reimbursement claim with your Flexible Spending Account (FSA) with HealthEquity is a straightforward process, though it comes with a few essential steps. Typically, you'll need to gather itemized receipts and complete a reimbursement form, ensuring that your expenses align with FSA guidelines.

What To Keep and Submit

When using your HealthEquity debit card, keep in mind, the administrator is going to require submission of supporting documentation.

Your documentation or receipt must include:

- Provider name on their own receipt or paperwork

- Date of Service

- The description of the qualified expense

- The amount charged

Most providers of services are keenly aware of these requirements, and their regular receipts and documentation are careful to denote these elements.

In most instances, you can easily submit your documentation by submitting a picture of the document using HealthEquity's mobile application.

Commuter Benefits (NY/NJ only)

Commuter benefits allow you to put money from your paycheck aside each month,

before taxes are taken out, for qualified mass transit and parking expenses.

Commuter Benefits

What does it cover?

Commuter funds can be used on a variety of transportation and parking expenses that allow you to travel to and from work. Eligible modes of

transportation include but aren’t limited to:

- Train or Ferry

- Bus or Subway

- Vanpool (must seat at least 6 adults)

- Parking or parking meter near your place of employment

Maximum Contributions

- Commuter Transit: $340

- Commuter Parking: $340

Contribution changes

You can adjust the amount you contribute to the plan each month at any time. No qualifying event is needed.

Rollovers and use-or-lose

The commuter plan is flexible and your funds will continue to roll over month to month until the funds are used. However, your funds will no longer be available if you terminate employment

Identity Theft Protection

Safeguard yourself and your family from evolving identity threats and scams with always-on protection from Allstate — made available to you by Verra Mobility.

Our enhanced 2026 identity protection features deliver stronger security to help you and your family stay ahead of rising scams and identity fraud. Get 24/7 monitoring, advanced scam detection, and expert support for peace of mind.

Note:

- Employer coverage will continue through 12/31.

- If planning to enroll, we recommend taking a screenshot of current selections before 12/31, as selections will not be carried over.

- Starting 1/1, employees can enroll by using this link: myaip.com/verramobility or by calling 1-800-789-2720.

- Payment by credit card only.

Benefit Decision Tool