Open Enrollment 2025

2025 Benefits Open Enrollment is an active enrollment, so every eligible U.S. employee must select or decline coverage options in MyVerraMobility. Enrollment opens on November 11, and employees must complete all actions before 11:59 p.m. MT on November 22 to ensure their preferred coverage selections start January 1, 2025.

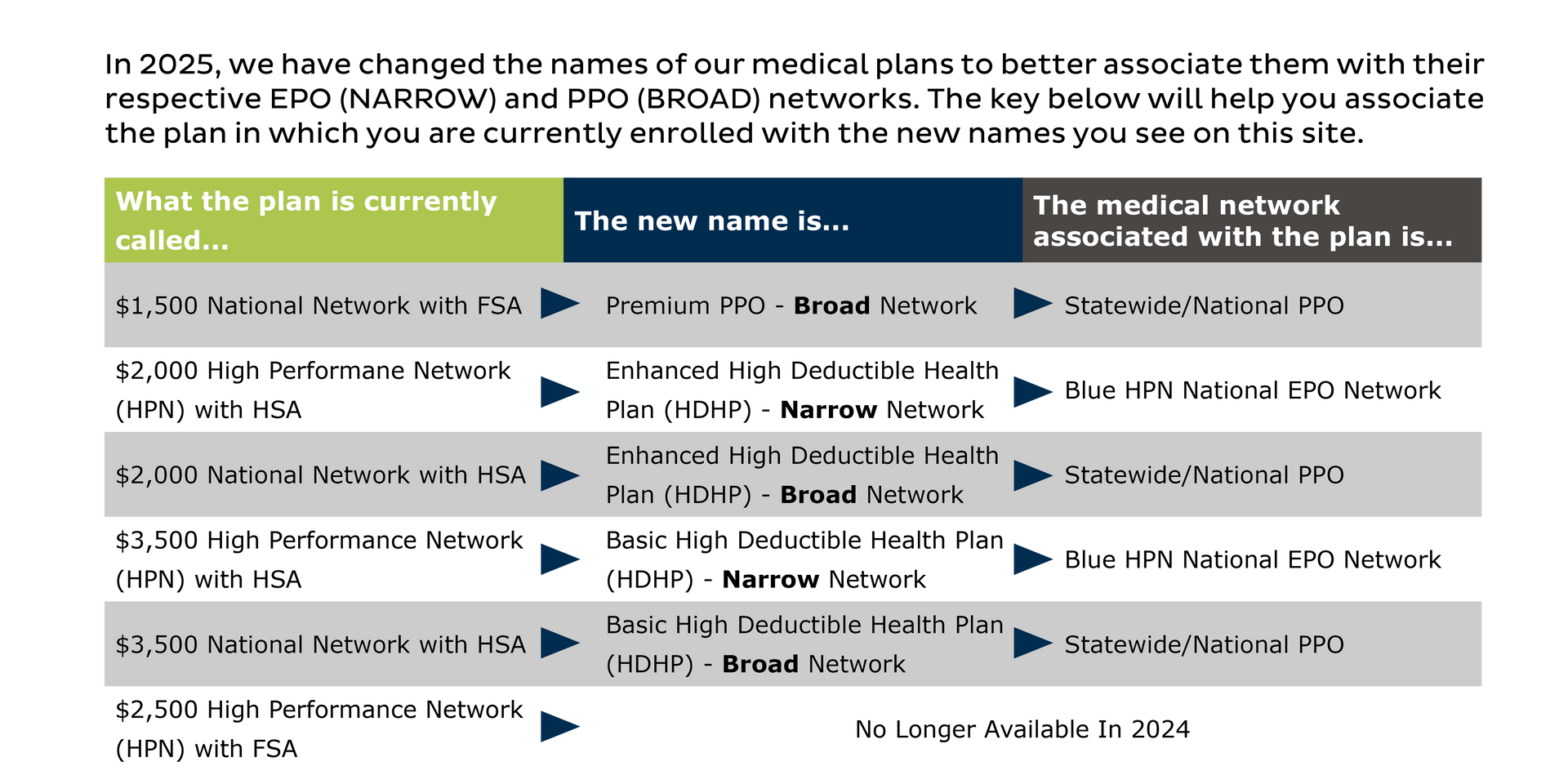

What's New for 2025?

List of Services

-

View/Download the 2025 Benefits Summary

For a quick highlights document, download the 2025 Benefit Summary

-

Three Medical Plan OptionsList Item 1

- Basic High Deductible Health Plan (HDHP) - Paired with the Narrow or Broad Network

- Enhanced High Deductible Health Plan (HDHP) - Paired with the Narrow or Broad Network

- Premium Preferred Provider Organization (PPO) - Paired with the Broad Network

-

Narrow Network vs. Broad NetworkList Item 2

Narrow Network

- In-Network Coverage Only

- No Out of Network Coverage

- Lower Premiums

- Quality Doctors & High-Quality Care

- Also referred to as the High Performance Network (HPN) within Blue Cross Blue Shield

Broad Network

- In-Network AND Out-of-Network Coverage

- In-Network Providers Cost Less Out-of-Pocket

- Higher Premiums

- Quality Doctors & High-Quality Care with more choices

- Also referred to as the PPO Network within Blue Cross Blue Shield

-

New Benefit Field GuideList Item 3

2025 Benefit Field Guide

-

Benefit Resource Center

- Insurance Claims, Problems, or Issues

- Benefit Plan Information

- Materials and Documents

- Guidance on How to Best Use One of Our Benefit Plans

Watch the 2025 Open Enrollment Presentation...

Remember, this is an "active open enrollment". You must login to MyVerraMobility and complete your annual enrollment elections.

What Is Open Enrollment?

Open enrollment is the one time each year when you can make changes to your current benefit elections or select new ones, unless you experience a

Qualifying Life Event.

What Should You Do?

During the open enrollment period, you will need to start by logging into

MyVerraMobility.

- Review your current elections.

- Login to the Nayya decision tool and model your choices to achieve the best fit for you and your family.

- Re-enroll or change your current elections, including adding or removing dependents.

- ACTION REQUIRED: current elections will not rollover from 2024 to 2025.

4. Click "Submit" to finalize your changes

Not Sure? Go to the Nayya Decision tool!

Nayya Decision Tool

We know that enrollment season can feel overwhelming and confusing. That’s why we’ve partnered with Nayya Choose to help you feel confident in your choices this year. Take a quick 10-minute survey and you’ll be matched with the benefits suited to your (and your family’s) unique needs.

Even if you have an idea of which benefits you want to select, Nayya Choose provides a data-driven recommendation that ensures you’ve considered all the options available to you.

How To Use Nayya

Click to view a quick guide on how to get in and use the Nayya Decision Tool.

Nayya FAQs

Click to view some of the Frequently Asked Questions about Nayya, its purpose and how to use it.

More Detail On Nayya

Click to view more detail on Nayya Choose and how to use it.

Eligibility

Eligible Employees:

You may enroll in the Employee Benefits Program if you are a full-time employee who is actively working 30 hours or more per week.

Eligible Dependents:

If you are eligible for our benefits, then your dependents are too. Generally, eligible dependents include:

- Your Legal Spouse.

- Civil Union - Colorado

- Common Law Spouse in Colorado, Idaho

- Registered Domestic Partner in California, Nevada, Oregon and Washington and children up to age 26

- If your child is mentally or physically disabled, coverage may continue beyond age 26 once proof of the ongoing disability is provided.

- Children may include natural, adopted, stepchildren and children obtained through court-appointed legal guardianship, as well as children of state-registered domestic partners.

When Coverage Begins:

Newly hired employees and dependents will be eligible on the first day of the month following 30 days of employment. All elections are in effect for the entire plan year and can only be changed during Open Enrollment unless you experience a Qualifying Life Event.

Medical Plan Network Options

For the upcoming plan year, effective January 1, if you choose the Basic or Enhanced Plan, you may choose to pair your plan with either a Narrow or Broad Network within Blue Cross Blue Shield of Arizona.

Our Basic and Enhanced Plans are both High Deductible Health Plans (HDHP), compatible with a Health Savings Account (HSA).

We also offer a Premium PPO plan, paired only with the Broad Network.

Medical plans

Your Choice!

There are three unique medical plan options, but certain plans include a choice of the two networks listed below:

- Broad Network - a comprehensive network throughout the country.

- Narrow Network (High Performance Network/HPN)

- a much narrower selection of providers who charge less for their services.

Very Important: When you pair the Basic or Enhanced plan with the Narrow network, you ONLY have access to doctors and hospitals in that Narrow network and will NOT have the option of seeing providers outside of this network.

What is the Narrow Network (High Performance Network / HPN)?

How does it work?

Learn how to navigate the provider search tool

Broad Network (PPO)

Blue Cross Blue Shield of Arizona

Wide Choice

The Broad Network option is most characterized by choice. This Network avails one of the largest and most comprehensive list of providers and facilities in the country. You also have the option of seeing providers outside of the network.

Things members should keep in mind

Our Broad Network medical plan offers a wide range of benefits and flexibility for individuals and businesses alike. One of the key features of pairing your plan with the Broad Network is the ability to choose your own healthcare providers without needing a referral. This allows for greater control over your healthcare decisions and ensures that you receive the best possible care.

The PPO provider charges are discounted, and there is no "balance billing" when using a provider from the network. Out-of-network care (using a provider not associated with the network) is different. Out-of-network providers may have higher charges and the ability to bill you for charges deemed "not covered" by our plans.

Narrow Network (High Performance Network / HPN)

Blue Cross Blue Shield of Arizona

By partnering with a select group of high-quality providers, this network offers superior care at lower costs, resulting in improved health outcomes and increased savings for employees. With access to leading hospitals, physicians, and specialists, you and your family can receive the best care possible while maintaining healthcare expenses in check.

Please know, the Narrow Network option is regionally limited. Please check the Narrow Network (HPN) search tool to make sure you are satisfied with the provider selection in your area.

Medical Plan Choices

HDHP Plan Options

IMPORTANT: Both the Basic and Enhanced HDHP plan options allow you to choose between two unique network options: The BROAD Network and NARROW Network.

- BROAD NETWORK: This network features a large, nationwide list of providers and hospitals, plus out-of-network plan benefits.

- NARROW NETWORK: This selection is less expensive out of your payroll, and providers charge lower fees for your care. However, the provider selection is more limited than the BROAD Network, and in some geographical areas, it may be prohibitively limited. Additionally, with the NARROW Network option, there is no out-of-network coverage.

Before electing the lower cost NARROW Network option, it is highly recommended that you first use the provider search feature to determine if there is an adequate participating provider list in your area.

PPO Plan Option

The Premium PPO Plan uses the BROAD Network option, only.

- BROAD NETWORK: This network features a large, nationwide list of providers and hospitals, plus out-of-network plan benefits.

Basic High Deductible Health Plan (HDHP)

- Pairs with Narrow or Broad Network

- Health Savings Account (HSA) Compatible Plan

*Review the providers in your area before choosing the Narrow Network option.

| Feature | In-Network Benefits |

|---|---|

| Calendar Year Deductible | $3,500 Individual $7,000 Family (Embedded deductible) |

| Max. Out-of-Pocket | $5,000 Individual $10,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | 80% After Deductible |

| Lab/X-ray | 80% After Deductible |

| Hospital Services | 80% After Deductible |

| Emergency Services | 80% After Deductible |

| Prescription Drugs | 80% After Deductible |

Enhanced High Deductible Health Plan (HDHP)

- Pairs with Narrow or Broad Network

- Health Savings Account (HSA) Compatible Plan

*Review the providers in your area before choosing the Narrow Network option.

| Feature | In Network Benefits |

|---|---|

| Calendar Year Deductible | $2,000 Individual $4,000 Family (Non-Embedded deductible) |

| Max. Out-of-Pocket | $2,000 Individual $4,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | 100% After Deductible |

| Lab/X-ray | 100% After Deductible |

| Hospital Services | 100% After Deductible |

| Emergency Services | 100% After Deductible |

| Prescription Drugs | 100% After Deductible |

Premium PPO Plan

- This plan pairs with the Broad Network only

- Compatible with the Flexible Savings Account (FSA)

| Feature | In Network Benefits |

|---|---|

| Calendar Year Deductible | $2,000 Individual $4,000 Family (Embedded deductible) |

| Max. Out-of-Pocket | $4,000 Individual $8,000 Family |

| Preventive Care | Covered in Full |

| Dr./Specialist | $20 copay / $40 Copay |

| Lab/X-ray | 80%; No Deductible |

| Hospital Services | 80%; After Deductible |

| Emergency Services | $250 Copay |

| Prescription Drugs | Tier 1: $10 |

| Tier 2: $35 | |

| Tier 3: $50 | |

| Tier 4: $100 |

Medical Plan Costs

BASIC HDHP PLAN

NARROW NETWORK

| Coverage Tier | <$50,000 Base Salary | >$50,000 Base Salary |

|---|---|---|

| Employee Only | $0.00 | $20.00 |

| Employee + Spouse | $52.02 | $102.02 |

| Employee + Child(ren) | $0.00 | $50.00 |

| Employee + Family | $134.42 | $209.42 |

BASIC HDHP PLAN

BROAD NETWORK

| Coverage Tier | <$50,000 Base Salary | >$50,000 Base Salary |

|---|---|---|

| Employee Only | $32.11 | $52.11 |

| Employee + Spouse | $119.44 | $169.44 |

| Employee + Child(ren) | $57.79 | $107.79 |

| Employee + Family | $234.27 | $309.27 |

ENHANCED HDHP PLAN

NARROW NETWORK

| Coverage Tier | <$50,000 Base Salary | >$50,000 Base Salary |

|---|---|---|

| Employee Only | $59.05 | $79.05 |

| Employee + Spouse | $177.07 | $227.07 |

| Employee + Child(ren) | $106.29 | $156.29 |

| Employee + Family | $320.76 | $395.76 |

ENHANCED HDHP PLAN

BROAD NETWORK

| Coverage Tier | <$50,000 Base Salary | >$50,000 Base Salary |

|---|---|---|

| Employee Only | $101.18 | $121.18 |

| Employee + Spouse | $265.53 | $315.53 |

| Employee + Child(ren) | $182.12 | $232.12 |

| Employee + Family | $451.77 | $526.77 |

PREMIUM PPO PLAN

BROAD NETWORK ONLY

| Coverage Tier | <$50,000 Base Salary | >$50,000 Base Salary |

|---|---|---|

| Employee Only | $300.57 | $320.57 |

| Employee + Spouse | $690.96 | $740.96 |

| Employee + Child(ren) | $539.63 | $589.63 |

| Employee + Family | $1,025.33 | $1,100.33 |

Premium Subsidy

Verra Mobility provides an additional medical premium subsidy for all benefits-eligible employees who earn an annual base salary under $50,000. Annual base salary for hourly employees is calculated by multiplying your hourly rate by 2,080 hours per year (overtime earnings are not included in the calculation). You must be enrolled in one of Verra Mobility’s medical plans to receive the subsidy.

The subsidy is provided through lower medical premium rates deducted from each paycheck while you are enrolled in a medical plan.

If the medical premium for the plan you elect is less than the subsidy, your premium cost will be $0 and you will not receive the difference. If your base salary is increased above $50,000, the subsidy will stop in the first paycheck reflecting your new pay rate.

| Enrollment | Subsidy |

|---|---|

| Employee Only | $20 |

| Employee + Spouse | $50 |

| Employee + Child(ren) | $50 |

| Employee + Family | $75 |

Your Smile, Our Priority

Explore Our Dental Insurance Plans

Verra Mobility is excited to offer three comprehensive dental insurance plans through Delta Dental, tailored to meet your needs. Our Basic DPPO (Delta Basic) and Enhanced PPO (Delta Enhanced) plans provide both in- and out-of-network benefits, giving you the flexibility to choose any provider. For maximum savings, we recommend selecting a Delta Dental provider. You can easily find a network provider by visiting deltadentalaz.com.

Our DHMO plan offers exclusive in-network benefits, ensuring you receive quality care at a lower cost. To locate a network provider for this plan, please visit deltadentalins.com.

Below, you'll find a summary table highlighting the key features of each dental plan. The coinsurance amounts reflect the plans share of the costs. For detailed information on coverage and exclusions, please refer to the official plan documents.

Choose the plan that best suits your needs and enjoy the peace of mind that comes with excellent dental coverage!

01 Basic DPPO Plan

The Basic DPPO plan offers essential coverage with flexibility and choice. As with any PPO, selecting a participating provider benefits you in two ways: lower cost per service and the provider will not balance bill for amounts greater than the contracted rate.

02 Enhanced DPPO Plan

The Enhanced DPPO plan works the same as the Basic DPPO plan, but with more benefit dollars available for you and your family's dental care. Plus, this plan covers orthodontic services!

03 Delta HMO Plan

The Delta DHMO plan works differently than a PPO. As a Dental Health Maintenance Organization, you are required to receive services from participating Delta DHMO network providers. Also, instead of an annual maximum, you can receive unlimited services at predetermined costs, captured in the Delta DHMO fee schedule.

Basic DPPO Plan

| Feature | In-PPO / Non-PPO |

|---|---|

| Calendar Year Deductible (Individual/Family) | $50 / $150 |

| Calendar Year Maximum Benefit | $1,200 |

| Preventive Care | 100% / 80% |

| Basic Care (Deductible Applies) | 80% / 60% |

| Major Care (Deductible Applies) | 50% / 30% |

| Orthodontic Care | Not Covered |

In the Basic DPPO plan, coinsurance amounts for Texas residence are the same in and out of the PPO network.

Enhanced DPPO Plan

| Feature | In-PPO / Non-PPO |

|---|---|

| Calendar Year Deductible (Individual/Family) | $50 / $150 |

| Calendar Year Maximum Benefit | $2,000 |

| Preventive Care | 100% / 100% |

| Basic Care (Deductible Applies) | 80% / 80% |

| Major Care (Deductible Applies) | 50% / 50% |

| Orthodontic Care | 50% up to $2,000 lifetime benefit |

In the Enhanced DPPO plan, coinsurance amounts for Texas residence are the same in and out of the PPO network.

Delta DHMO Plan

| Feature | In Network Only |

|---|---|

| Calendar Year Deductible (Individual/Family) | None |

| Calendar Year Maximum Benefit | None |

| Preventive Care | See copay schedule |

| Basic Care | See copay schedule |

| Major Care | See copay schedule |

| Orthodontic Care | See copay schedule |

The Delta DHMO plan is not available for Puerto Rico residents.

Vision Plan

Vision Plan

Our VSP vision plan is a PPO program, which means that the most cost-effective use of your benefits is within the PPO network. Luckily, Vision Service Plan has the largest vision PPO network in the country.

About VSP

Vision Service Plan (VSP) is a leading vision insurance provider that offers comprehensive coverage for vision health services. With a network of highly qualified eye care professionals, VSP ensures that individuals have access to quality eye care and affordable vision correction options. By prioritizing preventive eye care and regular eye exams, VSP helps individuals maintain optimal vision health and overall well-being. With VSP, you can rest assured that your vision needs are taken care of, allowing you to focus on what matters most in your personal and professional life.

Dental and Vision Plan Costs

DHMO PLAN

| Coverage Tier | Employer | Employee |

|---|---|---|

| Employee Only | $8.26 | $8.26 |

| Employee + Spouse | $16.52 | $16.52 |

| Employee + Child(ren) | $18.27 | $18.27 |

| Employee + Family | $27.16 | $27.16 |

BASIC DPPO PLAN

| Coverage Tier | Employer | Employee |

|---|---|---|

| Employee Only | $13.89 | $13.89 |

| Employee + Spouse | $26.29 | $26.29 |

| Employee + Child(ren) | $28.15 | $28.14 |

| Employee + Family | $41.82 | $41.81 |

Tobacco Surcharge and Cessation Program

Verra Mobility feels strongly that individuals should take responsibility for personal choices that may impact their health status.

Therefore, employees who certify that they are not tobacco users or have not used tobacco or nicotine products, including but not limited to cigarettes, cigars, snuff, chewing tobacco, pipes, electronic cigarettes, and electronic vaping devices, etc., regardless of method or frequency of use within the past six months, will pay less for medical insurance. All employees will be required to certify their tobacco use status during open enrollment and when first eligible for benefits.

If you currently use tobacco products, you can qualify for the discount by completing the American Lung Association (AlA) tobacco cessation program, which is available at no cost to you. Upon completion within 90 days of your benefits effective date, the non-tobacco discounted premiums will be retroactively applied via refund. We understand that quitting tobacco isn't easy, and we encourage you to contact ALA for cessation assistance and support. You will be assigned an AlA counselor who will provide individualized, one-on-one guidance through telephonic sessions. You will be required to complete 8 sessions within 90 days of your benefits effective date in order to qualify for the lower premium and retroactive refund of the surcharge. Download the tobacco cessation program enrollment form with the button below. Email the form to hifax@lung.org to get started.

We are committed to helping you achieve your best health. Employees enrolled in the medical plans are able to participate in these programs in order to avoid the surcharge. If you think you might be unable to meet the requirements to avoid the surcharge for any reason, contact benefits@veramobility.com to see if you might qualify for an alternate opportunity to avoid the surcharge.

Prescription Drugs

No Cost Preventive Care Medications

No cost preventive medications for all members

The Affordable Care Act also requires that certain medications such as contraceptives or vaccines be covered 100% for all medical plans. For a list of covered preventive prescriptions, please download the list from the Resource section at the top of this page.

Expanded no cost preventive medications for HSA plan members

To ensure you are able to receive the preventive prescriptions you need to maintain your health, Verra Mobility covers an expanded list of preventive prescriptions for members enrolled in the HPN or National Plans with an HSA. This makes it more affordable for you to fill the prescriptions you need.

Preventive prescriptions are used for the prevention of conditions such as high blood pressure, high cholesterol, diabetes, asthma, osteoporosis, heart attack, stroke, and prenatal nutrient deficiency.

Under the Narrow Network or Broad Network plans with HSA, preventive prescriptions on the HSA Preventive Drug List are available AT NO COST to you before meeting your deductible.

For a list of covered preventive prescriptions, download the “HSA Preventive Drug List”, or email benefits@verramobility.com.

Additional Pharmacy Benefits Information

Go to https://www.azblue.com/pharmacy

Here you will discover several useful tools to help you manage your household's prescription drugs:

- Price Edge discount pharmacy program

- Price a Drug Tool

- Understand and maximize your AZBlue pharmacy coverage

Mail Order Prescriptions

Employees enrolled in the Verra Mobility medical plans have access to mail order prescription delivery through BCBS. BCBS's mail order service is a convenient and cost-effective way for you to order up to 90-day supply of medication for delivery to your home. You will avoid having to visit a local retail pharmacy each month and save money on your prescriptions.

How to enroll in mail order

- Have your doctor write your maintenance medication prescriptions for 90 days.

- Enroll at

azblue.com/member. Remember to have your mailing address, phone number, any known allergies, and payment information handy to begin service.

GoodRx

GoodRx can help you save on your prescription drug costs. Download the free mobile app or visit goodrx.com today to see how much you could be saving.

Getting started is easy

- Download the app or visit goodrx.com.

- Search fr you medications by name or condition

- Compare prices and choose a pharmacy nearby

- Fill your prescription and claim your savings

NOTE: GoodRx is not an insurance plan, nor does it replace your BCBS prescription drug coverage. It is a prescription pricing service that enables you to comparison shop for medications and instantly redeem savings. GoodRx lets you know if there are discounts and coupons available for your medications, which can help you lower costs regardless of your medical insurance. If you have insurance, GoodRx allows you to view your costs through the plan and identify any restrictions before you go to the pharmacy.

What Are Important Considerations?

- Be sure to check and update your life insurance beneficiaries.

- Double check the spelling of each family member's name and ensure the dates of birth are correct as well

- Calculate your total plan costs

Health Savings Account

HSA Match and Contribution Limits

Verra Mobility HSA Match

In addition to the triple-tax savings benefit of the Health Savings (HSA), Verra Mobility will match your deposits, up to the following limits:

Employee only: Up to $700

Employee + Spouse: Up to $1,200

Employee + Child(ren): Up to $1,200

Employee + Family: Up to $1,700

2025 HSA Contribution Limits

In 2025, the maximum deposit for an individual is $4,300 per individual and $8,550 for families. Plus, if you are 55+, you may deposit an additional $1,000. Verra Mobility will help you save by matching your HSA contribution. This contribution will be pro-rated and will occur in every paycheck.

Note: The above limits are from all sources. Specifically, Verra Mobility matches your contributions toward your HSA (please see below for more details). Therefore, the maximum contribution limit is the combination between the amount you and Verra Mobility contribute toward your account.

What is an HSA?

A Health Savings Account (HSA) is a tax-advantaged account that allows you to save for medical expenses. It works in conjunction with a High-Deductible Health Plan (HDHP) and offers benefits like tax-free contributions and withdrawals for qualified medical expenses.Who can contribute to an HSA?

Anyone enrolled in a qualified HDHP can contribute to an HSA. This includes individuals with self-only or family coverage. Contributions can be made by the account holder, their employer, or anyone else on their behalf.Does Verra Mobility make a contribution toward my HSA?

If you enroll in the Base HDHP or Enhanced HDHP plan, Verra Mobility will help you save by matching your HSA contribution. This contribution will be pro-rated and will occur in every paycheck. For new hires, Verra Mobility’s first contribution will be made within the first pay period after you are benefits-eligible.

What are the tax benefits?

HSAs offer triple tax benefits: contributions are tax-deductible, the account grows tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a powerful tool for managing healthcare costs.Can I deposit to an HSA and have another plan, like an FSA?

No. You are not allowed to enroll and contribute toward the traditional Health Care FSA, while also being enrolled in the HSA. There is an FSA that is compatiable with your HSA. You may only enroll and contribute toward a Limited Purpose FSA along side your HSA.

Do I lose my money if I don't use the funds at the end of the year?

No. Unlike the FSA where the funds are use it or lose it, funds in the HSA rollover from year to year.

Flexible Spending Account

Health Care FSA

The Health Care Flexible Spending Accounts (FSA) can be used to cover a wide range of expenses, including co-pays, deductibles, prescription medications, and certain over-the-counter items. Health Care FSAs offer a tax advantage by reducing taxable income and can help individuals save money on out-of-pocket healthcare costs.

Limits

As of 2025, the Health Care FSA contribution limits is set at $3,300 per year. These limits are subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Rollover

Funds remaining in the Health Care FSA will rollover to the following year. Any funds that exceed $660 will be lost. You have 90 days after the end of the year to submit for reimbursement for the current year expenses.

To avoid overfunding your Health Care FSA, carefully consider your regular out-of-pocket, eligible medical expenses and best estimate what you may spend in 2025.

Limited Purpose FSA

A Limited Purpose Flexible Spending Account (FSA) is a type of account that allows you to set aside pre-tax dollars to pay for eligible medical expenses.

Unlike a traditional Health Care FSA, a Limited Purpose FSA has restrictions on the types of expenses that can be reimbursed, typically only covering specific expenses such as dental and vision care.

Limited Purpose FSAs are often offered in conjunction with a high-deductible health plan and are subject to annual contribution limits set by the employer. Any funds left in a Limited Purpose FSA at the end of the plan year may be forfeited, so it's important to plan expenses carefully.

Limits

As of 2025, the Limited Purpose FSA contribution limits is set at $3,300 per year. These limits are subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Rollover

Funds remaining in the Limited Purpose FSA will rollover to the following year. Any funds that exceed $660 will be lost. You have 90 days after the end of the year to submit for reimbursement for the current year expenses.

To avoid overfunding your Limited Purpose FSA, carefully consider your regular out-of-pocket, eligible medical expenses and best estimate what you may spend in 2025.

Dependent Care FSA

A Dependent Care Flexible Spending Account (DFSA) is a pre-tax benefit account that allows employees to set aside money to cover eligible dependent care expenses. These expenses typically include child care, day care, preschool, summer day camp, and before or after school care for children under the age of 13, as well as care for elderly or disabled dependents.

Employees contribute a portion of their pre-tax salary to the Dependent Care FSA, which can then be used to reimburse themselves for eligible expenses. This can result in significant tax savings, as the contributions are not subject to federal income tax, Social Security tax, or Medicare tax.

Limits

The DFSA limit is $5,000 per household, or $2,500 if married and filing separately. This limit is subject to change based on inflation and other factors. It is always recommended to check with your employer or FSA administrator for the most up-to-date information on contribution limits.

Use It Or Lose It

It's important to note that funds in a Dependent Care FSA are "use it or lose it," meaning that any unused funds at the end of the plan year are forfeited. However, some employers may offer a grace period or carryover option to allow employees to use up remaining funds.

Using Your FSA, LFSA, or DFSA

Filing an expense reimbursement claim with your Flexible Spending Account (FSA) with HealthEquity is a straightforward process, though it comes with a few essential steps. Typically, you'll need to gather itemized receipts and complete a reimbursement form, ensuring that your expenses align with FSA guidelines.

What To Keep and Submit

When using your HealthEquity debit card, keep in mind, the administrator is going to require submission of supporting documentation.

Your documentation or receipt must include:

- Provider name on their own receipt or paperwork

- Date of Service

- The description of the qualified expense

- The amount charged

Most providers of services are keenly aware of these requirements, and their regular receipts and documentation are careful to denote these elements.

In most instances, you can easily submit your documentation by submitting a picture of the document using HealthEquity's mobile application.

Commuter Benefits

Commuter benefits allow you to put money from your paycheck aside each month,

before taxes are taken out, for qualified mass transit and parking expenses.

Commuter Benefits

What does it cover?

Commuter funds can be used on a variety of transportation and parking expenses that allow you to travel to and from work. Eligible modes of

transportation include but aren’t limited to:

- Train or Ferry

- Bus or Subway

- Vanpool (must seat at least 6 adults)

- Parking or parking meter near your place of employment

Maximum Contributions

- Commuter Transit: $325

- Commuter Parking: $325

Contribution changes

You can adjust the amount you contribute to the plan each month at any time. No qualifying event is needed.

Rollovers and use-or-lose

The commuter plan is flexible and your funds will continue to roll over month to month until the funds are used. However, your funds will no longer be available if you terminate employment

Verra Mobility's Retirement Savings Program

We're proud to partner with Empower for our 401(k) retirement savings program. With their expertise, you can confidently grow your savings while focusing on what we do best. Together, we’re not just enhancing mobility today, but also paving the way for a brighter, financially secure tomorrow for all our team members.

Retirement Savings

All employees, age 18 an older, are eligible to participate in the 401(k) plan, except,

- Employees who are residents of Puerto Rico

- Employees covered by a collective bargaining agreement

- Non-resident aliens with no U.S. earned income

- Leased employees

- Interns and temporary employees unless such employees work 1,000 hours in an eligibility computation period

When can you begin making contributions to the plan?

You become eligible to participate in the 401(k) plan the first of the month following 30-days full time employment. The first contribution date depends on when you make your contribution election and the payroll cutoff date, but generally begins as soon as administratively possible.

Automatic Enrollment

Our plan is an an auto-enrollment program. This means, if you make no elections, a contribution of 5% will begin to occur automatically from your payroll. If you wish to not contribute to your 401(k), you must log into Empower and set your contributions to 0%.

Roth Contributions

The IRS limits your annual Roth contributions to remain at $7,000 in 2025. However, if you are 50+ years in age, you may make an additional contribution of up to $7,500 in 2025.

Matching Contribution

Good news! Verra Mobility matches your 401(k) contribution, dollar-for-dollar, for the first 4% you contribute. You are immediately vested in all contributions matched by Verra Mobility.

How To Enroll

Empower will mail an enrollment packet to your home address. Follow the packet's instructions on how to elect, select investments, and roll-over balances from another 401(k) plan into your Verra Mobility 401(k) account.

Life Insurance

Basic Life and Accidental Death & Dismemberment (AD&D) coverage.

Your basic life insurance and accidental death and dismembered insurance is a benefit fully paid by Verra mobility.

Basic Life Insurance

The basic life policy covers you up to 1x your annual base salary, up to $400,000.

Accidental Death & Dismemberment

If you're passing is a result of an accident, the A&E benefit is equal to the basic life insurance benefit of one times your annual base salary, up to $400,000

Beneficiary

Please review your benefits area assignments to ensure that all the information is up-to-date and correct.

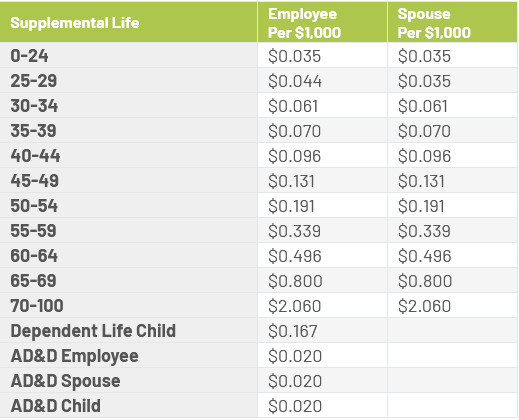

Supplemental Life Insurance

Verra Mobility provides you the option to purchase Supplemental Life and AD&D insurance for yourself, your spouse, and your dependent children through Prudential.

You must purchase supplemental coverage for yourself in order to purchase coverage for your spouse and/or dependents. When you enroll you will see your exact cost for coverage based on your age and how much you buy. Benefits will reduce by 50% at age 70. For Spouse coverage benefits will reduce by 100% at age 70.

- Employee: $10,000 increments up to 5x annual earnings or $500,000, whichever is less—guarantee issue: $200,000

- Spouse: $5,000 increments up to $150,000 or 100% of the employee’s election, whichever is less—guarantee issue: $30,000

- Dependent children: Birth to age 26: $10,000—guarantee issue: $10,000

If you elect supplemental coverage, you may purchase up to the guaranteed issue amount(s) without completing a statement of health (evidence of insurability). If you do not enroll when first eligible, and choose to enroll during a subsequent annual open enrollment period, you may be required to submit evidence of insurability (EOI) for the coverage you request. Any amounts requiring EOI will not take effect until approved by Prudential.

Depending on your personal situation, Basic Life and AD&D insurance might not be enough coverage for your needs. To protect those who depend on you for financial security, you may want to purchase supplemental coverage.

Use the Life Insurance Needs Calculator to help determine how much coverage is right for you.

Disability Insurance

Disability Insurance

One of your most important benefits is the ability to support your household during a period where you are disabled and unable to earn.

Short Term Disability

Income protection for short term disability is provided through Prudential. This coverage is there to provide income during a period where you are unable to work due to illness or injury.

Coverage includes

Maternity

- Weeks 1-8: 100% of salary, up to $2,000 per week

- Weeks 9-26: 60% of salary, up to $2,000 per week

- Elimination Period: 0-days

All Other Disabilities

- Week 1: $0 (Use PTO or PSL)

- Weeks 2-8: 80% of salary per week, up to $2,000

- Weeks 9-26: 60% of salary per week, up to $2,000

- Elimination Period: 7-day

Long Term Disability

Verra Mobility provides comprehensive Long Term Disability (LTD) income protection at no cost to you. LTD is a critical benefit, in that it allows you to maintain your household needs while you are unable to work because of illness or injury.

Eligibility Period

The LTD program is designed to dovetail with the above Short Term disability policy: You are eligible for this benefit if you are disabled for 180-days.

The Benefit

- 60% of your base salary, up to $15,000 per month

- Elimination Period: 180-days

- Benefit Duration: Through regular Social Security retirement age

Life can be a juggling act, filled with challenges from financial pressures to family dynamics and job-related stress. At Verra Mobility, we understand that these distractions can weigh heavily on your mind, impacting your focus and productivity. That’s why our Employee Assistance Program (EAP) is here to lend a hand. With a range of tools and resources at your fingertips, you can find the support you need to navigate life’s hurdles, allowing you to stay on the road to success—both personally and professionally.

Online Resources

Workplace Options is an online resource available 24/7 to help you find answers to pressing concerns and questions.

There, you can read articles and view presentations on a wealth of subjects.

Care Options

The need for family care has become multidimensional and multi-generational. The EAP can help you find solutions and resources to help provide care for those you love.

Financial and Legal

The EAP avails 30-minute consultations for financial and legal assistance at no cost to you. Additional, you can receive 25% discount on tax planning, tax preparation, and select legal fees.

Support Throughout The Year

You and your family have access to mental health professionals throughout the year.

Connect with a mental health professional about family issues, alchohol or drug dependencies, depression, anxiety, or general stress.

Why Reach Out to the EAP?

Your Employee Assistance Program (EAP) is here to support you through various challenges, whether they are personal or work-related. It's a confidential resource designed to help you navigate life's ups and downs, ensuring you maintain your well-being and productivity.

Emotional Well-being

Feeling overwhelmed or anxious? The EAP can provide you with the support you need to manage your emotional health effectively.Work-Related Stress

If job-related stress is affecting your performance or happiness, reach out to discuss strategies for coping and improving your work environment.Personal Issues

Facing personal challenges like relationship troubles or grief? The EAP can help you find ways to cope and heal.Substance Abuse

If you or a loved one is struggling with addiction, the EAP offers resources and support to help you through this difficult time.Financial Concerns

Experiencing financial stress? The EAP can provide guidance on managing your finances and reducing stress.

Your Well-being Matters

Don't hesitate to reach out to the EAP whenever you feel the need. It's a safe space to discuss your concerns and find the support you deserve.

global.helpwhereyouare.com (your company code: verraemployee)

919-706-4551

Toll-free 888-851-7032

Voluntary Insurance Products

Accident Insurance

Verra Mobility provides you the option to purchase Accident insurance through Cigna.

Accident insurance helps protect against the financial burden that accident-related costs can create. This means that you will have added financial resources to help with expenses incurred due to an injury, to help with ongoing living expenses, or to help with any purpose you choose. Claims payments are made in flat amounts based on services incurred during an accident. Refer to the Cigna flyer to view plan details and compare the three plan options.

Examples of covered conditions

- Burns

- Dislocations

- Lacerations

- Broken Bones

- Concussion

- Fractures

- Medical service related to an

- accident

Accident insurance costs

Listed here are the monthly costs for accident insurance. The amount you pay for coverage is deducted from your paycheck on a post-tax basis.

Accident Low Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $6.25 |

| Employee + Spouse | $9.82 |

| Employee + Child(ren) | $10.38 |

| Employee + Family | $16.34 |

Accident Mid Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $10.54 |

| Employee + Spouse | $16.62 |

| Employee + Child(ren) | $18.82 |

| Employee + Family | $29.39 |

Accident High Plan

| Enrollment | Premium |

|---|---|

| Employee Only | $15.12 |

| Employee + Spouse | $23.29 |

| Employee + Child(ren) | $26.67 |

| Employee + Family | $41.73 |

Critical Illness

Verra Mobility provides you the option to purchase Critical Illness insurance through Cigna.

Critical Illness insurance provides a financial, lump-sum benefit upon diagnosis of a covered illness. These covered illnesses are typically very severe and likely to render the affected person incapable of working. Because of the financial strain these illnesses can place on individuals and families, critical illness insurance is designed to help you pay your mortgage, seek experimental treatment, or handle unexpected medical expenses.

A health screening benefit is automatically included in the plan. This plan will pay $50 per insured individual per calendar year when a covered health screening test is performed.

Examples of covered conditions

- Circulatory conditions such as heart

- attack or stroke

- Cancer conditions

- Other conditions such as benign

- brain tumor, major organ failure,

- paralysis, and coma

Benefit options

- Employee: $5,000, $10,000, $15,000, $20,000

- Spouse/Domestic Partner: $5,000, $7,500, $10,000

- Child(ren): $5,000

Rates are age banded for employee and spouse differentiating between smoker and non-smoker. Spouse rates are based on the employee’s age. Child rates are a flat dollar amount. Refer to the Cigna flyer to view plan details and costs. If you choose to increase your coverage or are electing coverage for the first time, you will be subject to pre-existing condition limitations.

Hospital Indemnity Insurance

Verra Mobility provides you the option to purchase Hospital Indemnity insurance through Cigna.

A hospital stay can happen at any time, and it can be costly. The Hospital Indemnity plan can help you and your loved ones have additional financial protection. This plan pays benefits for hospitalizations resulting from a covered injury or illness. Coverage continues after the first hospitalization, to help you have protection for future hospital stays.

A health screening benefit is automatically included in the plan. This plan will pay $50 per insured individual per calendar year when a covered health screening test is performed.

The table to the right highlights some of the benefits of the Hospital Indemnity plan. Please refer to the Cigna plan summary for additional details. Benefits will be subject to pre-existing condition limitations.

Pet Insurance

Nationwide offers two plans for you to choose from: My Pet Protection® and My Pet Protection® with Wellness500.

My Pet Protection is a medical plan that offers an annual benefit of $7,500 for eligible veterinary bills related to accidents, injuries and illnesses, including emergency clinics and specialists.

My Pet Protection with Wellness500 offers the same protection as our medical plan, but includes coverage for preventive care. With this plan, up to $500 of the annual $7,500 benefit can be used for wellness, including checkups, flea and heartworm preventives, vaccinations, spay and neuter and more.

Both plans are guaranteed issuance, have a $250 annual deductible and include medical coverage with the choice of 50% or 70% reimbursement levels.